NFEC Launches Nationwide Initiative to Declare Financial Instability a Public Health Emergency

WASHINGTON DC, DC, UNITED STATES, July 17, 2025 /EINPresswire.com/ -- The National Financial Educators Council (NFEC) has officially launched a nationwide campaign to recognize financial instability as a Public Health Emergency. The organization is calling on local, state, and national leaders to formally acknowledge the serious health risks driven by financial insecurity—aligning this effort with the CDC’s Social Determinants of Health (SDOH) framework.

This movement emphasizes the proven, measurable connection between financial hardship and poor health outcomes, and proposes proactive solutions centered around financial education, personalized coaching, and career readiness training.

Download whitepaper and watch video.

“Financial instability is not just an economic issue—it’s a public health crisis that is quietly eroding the well-being of millions,” stated Vince Shorb, CEO of the NFEC. “When we officially classify it as a public health emergency, we can begin to unlock the level of coordinated resources and attention this issue demands.”

Financial Instability’s Health Toll

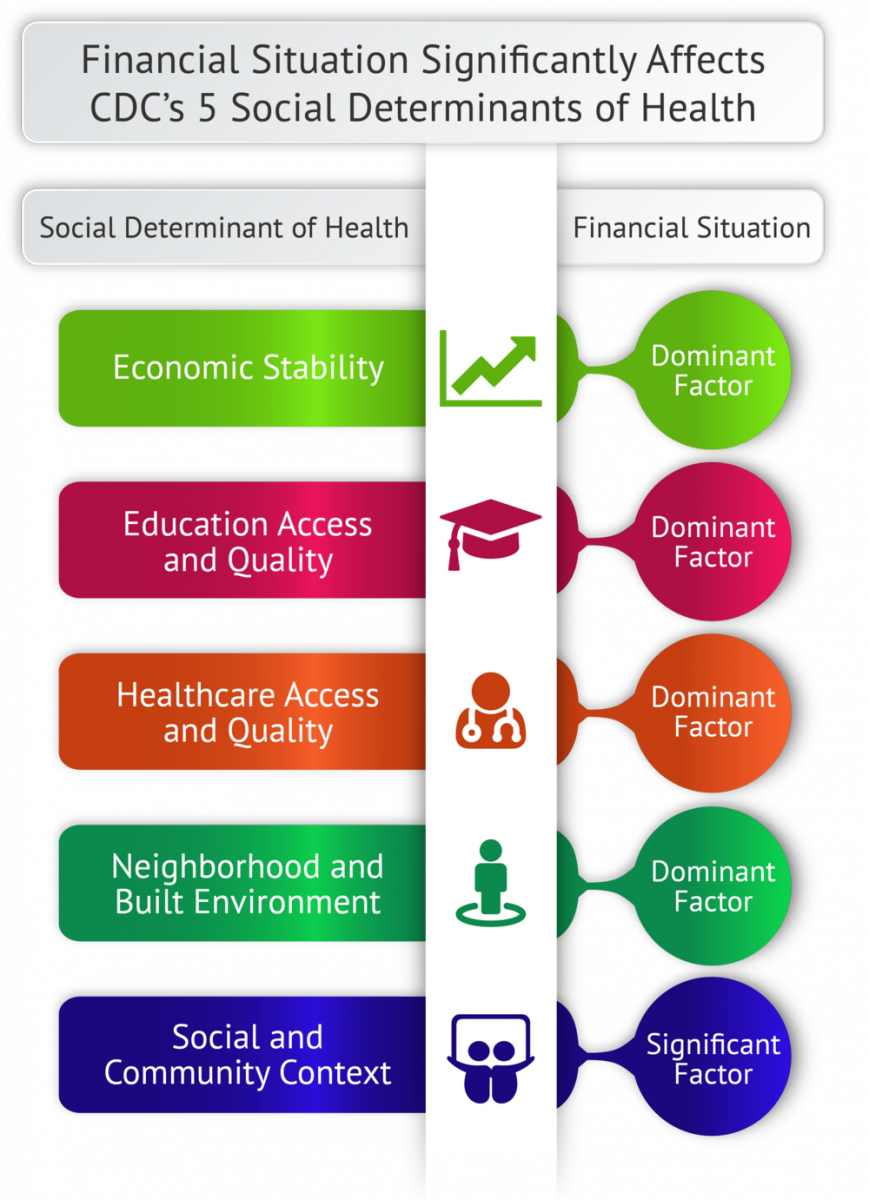

The U.S. Department of Health and Human Services, the Centers for Disease Control and Prevention (CDC), and the Healthy People 2030 initiative all recognize five key Social Determinants of Health. Each is significantly impacted by an individual’s financial situation:

-Economic Stability: Unstable employment, housing insecurity, and poverty directly worsen health outcomes.

-Education Access & Quality: Students from financially disadvantaged backgrounds are less likely to graduate, which correlates with chronic health risks.

-Healthcare Access & Quality: About 10% of Americans remain uninsured, leading to delayed care and deteriorating health.

-Neighborhood & Built Environment: Low-income areas face greater exposure to environmental hazards, crime, and limited resources.

-Social & Community Context: Financial stress increases social isolation, mental health issues, and susceptibility to unsafe environments.

“Financial insecurity is deeply intertwined with America’s most pressing health concerns,” said Shorb. “The data is clear: to improve public health, we must prioritize financial capability as a front-line intervention.”

A Public Health Solution: Integrating Financial Wellness

The NFEC asserts that recognizing financial instability as a Public Health Emergency would provide a pathway to:

-Advance Early Prevention: Embed financial education across all school levels, just as public health campaigns integrate vaccination and wellness programs.

-Expand Support Systems: Increase access to financial coaching, counseling, and workforce readiness services for those in need.

-Accelerate Action: Enable emergency-level funding, foster public-private partnerships, and implement rapid-response solutions—similar to emergency health mobilizations.

This September, the NFEC will lead United for Action Week, a national activation focused on stakeholder collaboration, legislative outreach, media campaigns, and coordinated advocacy to advance the emergency declaration.

Join the United for Financial Literacy Advocacy Committee.

The organization is inviting public health professionals, educators, nonprofit leaders, policymakers, and corporate partners to join the cause and push for policies that elevate financial wellness as an essential component of health equity.

“The urgency is now,” added Shorb. “The systems are in place, the models exist—we simply need to act. Together, we can transform communities and build a healthier nation through financial empowerment.”

The NFEC is a Certified B Corporation™ and an IACET Accredited Provider dedicated to equipping a global network of financial wellness advocates with the tools, training, and resources necessary to drive sustainable, community-level impact.

Claudia Martins

National Financial Educators Council

+1 702-620-3059

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Financial Public Health Emergency

Distribution channels: Banking, Finance & Investment Industry, Healthcare & Pharmaceuticals Industry, Human Rights, Politics, U.S. Politics

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release